Revolutionary Predictive Analytics Trends Shaping Healthcare Payers’ Future in 2024

Executive Summary:

Over the past few years, payers have been going through a digital metamorphosis. This digital transformation, like any industry-wide shift, is about staying ahead of the curve.

Short of having a crystal ball, harnessing predictive analytics is the best way payers can strategically outpace the competition and cultivate a sustainable, seamless business.

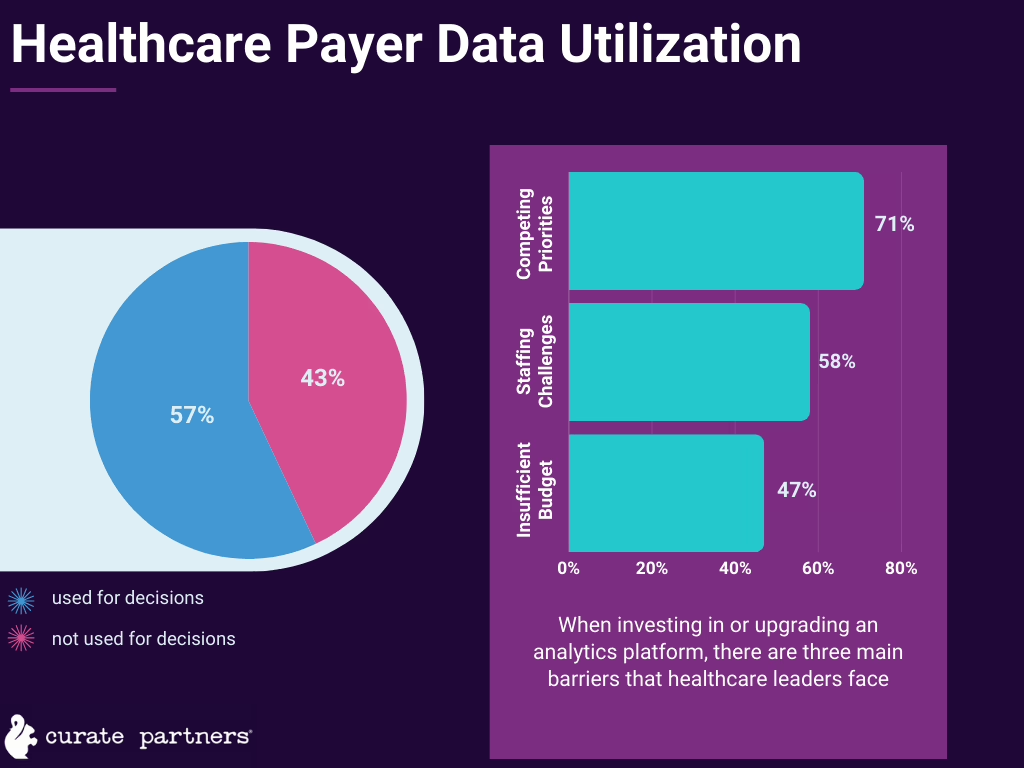

Yet, even in 2023, reports suggested that healthcare organizations—even payers—have been underutilizing their data for forward-thinking business decisions.

In 2024, the stakes of putting that data to work have never been higher.

- Consumer expectations continue to push toward sleek digital and personalized experiences.

- The push toward value-based care further emphasizes closer relationships between providers and payers.

- Shifting Medicare regulations emphasize how payers can and must wield their data and step up efficiency and transparency.

- A contracting workforce demands more clear-cut delegation and management.

In response to these pressures, we expect payers to up their predictive analytics game in a few key ways. To get you up to speed, here are five of the most impactful ways we’re advising our payer clients to implement predictive analytics in their payer organizations.

This year’s top predictive analytics trends for payers:

- Claims analytics

- Care gap alerts

- Provider network optimization

- Customer experience personalization

- Cost transparency visualization

Trend #1: Reducing costs and improving health with claims analytics

Applying predictive data analytics to claims can expedite claims processing, cutting out inefficiencies and identifying opportunities for automation.

But there’s an even more compelling use case for analyzing past claims. Hidden in that data are clues as to which patients are likely to incur high-cost medical care in the future. Identifying these patients and intervening with preventive health measures improves these patients’ chances to avoid worsening conditions—and it saves payers money.

McKinsey machine learning analysis used Medicare fee-for-service data to demonstrate how predictive analytics can accurately identify readmission risk. They found that, for the five percent of patients identified with the highest readmission risk, 75 percent were readmitted.

Analytics-enabled targeted intervention could allow payers to coordinate with provider teams and keep at-risk patients out of the hospital. One such intervention program from a New York-based health plan resulted in a 21% reduction in readmissions.

Plus, with advances in artificial intelligence, predictive analytics allows for more real-time insights, helping payers make smarter decisions.

Trend #2: Staying on top of high-risk populations with clinical alerts

If you’ve been in the health IT world as long as we have, clinical alerts may sound like old news to you.

Yes, EHR-based ADT (admission, discharge, transfer) alerts have been helping providers better intervene on their high-risk patients’ behalf since the rise of EHR adoption in the last decade.

Now, recent advances in machine learning have increased how specific we can get with clinical alerts. As a result, more health data solutions have begun offering comprehensive care gap analysis for high-risk patients.

This analysis makes it easier for healthcare payers to stay on top of their HEDIS scores and other quality measures. Optimizing those measures required payers and providers to carefully coordinate care—especially when it comes to chronic care management.

Plus, with increasing the availability of care gap data to providers, payers have an opportunity to offer provider networks more value and deepen those relationships. Healthcare payers are perfectly poised to offer their providers these kinds of care gap alerts based on their wealth of claims information.

Trend #3: Building and keeping high-quality provider networks

We hear this from our payer clients often: In such a competitive market, payers are scrambling to minimize provider churn.

Attracting and retaining a high-caliber provider network doesn’t have to be complicated. For one, offering data analytics services makes providers likelier to stay loyal to a payer by increasing satisfaction.

But ultimately, payers do need to think bigger when it comes to keeping and entering new markets. Analyzing provider performance can help payers stay on top of waste, care variability, and network leakage.

As an example, we would advise a proactive leakage mitigation strategy of minutely tracking provider performance. Specialty physician billing is behind about a quarter of healthcare spending. And studies estimate that inappropriate referrals across all conditions happen between 12.4 to 30 percent of the time.

Noting the culprits behind network leakage can help payers smoothly intervene—whether by enticing new providers to join the network or offering incentives to in-network providers to minimize outside referrals. One plan’s data-driven interventions led to an 18% increase in high-value referrals by primary care providers.

Predictive analytics can also allow payers to more confidently enter new markets. Payers can forecast the effects of network changes using available data and provider performance benchmarks. However, processing, cleaning, and normalizing provider performance data across such a wide span can be incredibly time-consuming. We’d recommend predictive analytics solutions to cut down on the costs of this market research.

Trend #4: Getting inside the consumer’s mind

In today’s personalized, consumer-centric landscape, generic messaging and experiences don’t cut it anymore. Effective digital transformation means prioritizing customer experience (CX).

Predictive analytics is a key tool for optimizing your consumer-facing front end. When applied to member interaction data, payers can use predictive trends to create a roadmap for hyper-personalized and razor-sharp CX.

When we’re helping our payer clients build out digital CX and marketing campaigns, data-driven experimentation is core to our process. Through one such project, we helped a client enhance patient adherence and engagement metrics using a data-driven campaign personalization strategy.

When working with another payer client, we wielded our collected customer interaction data to generate new use cases for building out their integrated digital experience for members. For this client, our primary focus was on the ‘Member 360 Record,’ facilitating smooth transitions from Commercial Health Plans to Medicare for those aged 60+. Our analytics-driven decisions helped us create a consistent CX tailored for members going through this transition.

Trend #5: Visualizing cost transparency

Healthcare is a trust-based industry. Members face an increasing power of choice in plan selection. Payer-provider relationships are moving toward value. Now more than ever, building that trust is sink-or-swim for payers.

Whether it comes to member or provider relationships, much of the trust payers can build is grounded in cost transparency. Plus, with CMS regulation, cost transparency is no longer optional. More and more payers are upping their compliance.

Predictive analysis makes cost transparency easier to deliver with custom data visualization platforms.

We’ve worked with one of our payer clients to create one such cost transparency data-as-a-product platform. The resulting product and updated FinOps processes helped our client transition to a data product mindset, offering greater transparency and value within their native platform.

Takeaways: How payers use data determines their reputation

To discover more about how we transform payer data into actionable growth strategies for our clients, click here.