The 2024 Customer Service Transformation:

Generative AI's Pivotal Role

The GenAI Revolution in Customer Service

Pros

Enhanced Efficiency: AI-driven tools will significantly speed up response times and improve accuracy in handling customer inquiries.

Personalized Interactions: GenAI can provide tailored responses, creating a more personalized experience for customers.

Cons

Depersonalization Risk: Over-reliance on AI might lead to a lack of personal touch in customer interactions.

Technical Complexity: Implementing and maintaining GenAI solutions requires technical expertise and resources.

Impact: Elevating Customer Experiences

Analogies and Examples:

AI as a Skilled Concierge: Just like a concierge knows guests’ preferences, GenAI can anticipate customer needs and offer personalized assistance.

The AI-Assisted Physician: Imagine a doctor (customer service agent) with an AI assistant providing instant information to diagnose and treat patients (solve customer issues) more effectively.

Impact: Elevating Customer Experiences

Analogies and Examples:

AI as a Skilled Concierge: Just like a concierge knows guests’ preferences, GenAI can anticipate customer needs and offer personalized assistance.

The AI-Assisted Physician: Imagine a doctor (customer service agent) with an AI assistant providing instant information to diagnose and treat patients (solve customer issues) more effectively.

Curate's Role: Navigating the GenAI Wave

Curate’s AI Advisory services are crucial in guiding businesses through the adoption and optimization of GenAI in customer service.

- Strategic AI Implementation: We help design strategies that integrate GenAI seamlessly into customer service models.

- Balancing AI and Human Elements: Curate ensures that while AI enhances efficiency, the human element in customer service remains intact.

where your program is excelling and where it falls short.Metrics help pinpoint areas with the highest error rates or potential for improper payments. This allows you to focus your resources and refine your strategies for maximum impact.

where your program is excelling and where it falls short.Metrics help pinpoint areas with the highest error rates or potential for improper payments. This allows you to focus your resources and refine your strategies for maximum impact.

Creating an elevated digital experience takes more than one step of automation. Don’t miss our specialized

Creating an elevated digital experience takes more than one step of automation. Don’t miss our specialized  From our years of working with payer businesses, we understand that one of the biggest headaches is coordinating and integrating unstructured data.

From our years of working with payer businesses, we understand that one of the biggest headaches is coordinating and integrating unstructured data.

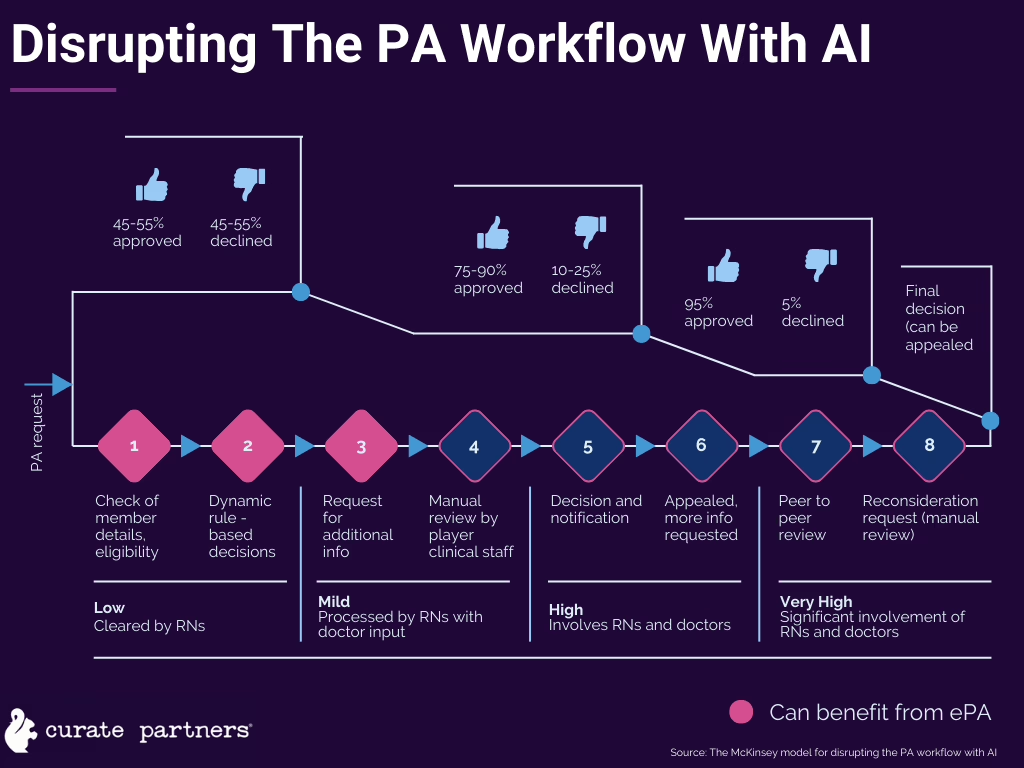

This is where cognitive agents come in. This automation technology bridges NLP with machine learning, creating virtual entities—agents—that perform tasks typically requiring human intelligence.

This is where cognitive agents come in. This automation technology bridges NLP with machine learning, creating virtual entities—agents—that perform tasks typically requiring human intelligence.

As intended, electronic PA intends to improve patients’ access to care, keeping the flow of information moving between facilities, payers, and patients.

As intended, electronic PA intends to improve patients’ access to care, keeping the flow of information moving between facilities, payers, and patients.